Debt Recycling for Doctors and Dentists

It is common to see a dentist spouse with a large non-deductible debt, like a home loan which is not tax-deductible. This

makes it very costly because if the interest on the loan is 6% and the doctors tax rate is 47%, the doctor has to earn almost

twice the amount to pay off the interest. This means the real cost of the interest on the loan is closer to 12%. That's why we always

recommend that clients pay off non-deductible debt first.

It is common to see a dentist spouse with a large non-deductible debt, like a home loan which is not tax-deductible. This

makes it very costly because if the interest on the loan is 6% and the doctors tax rate is 47%, the doctor has to earn almost

twice the amount to pay off the interest. This means the real cost of the interest on the loan is closer to 12%. That's why we always

recommend that clients pay off non-deductible debt first.

To avoid this situation, a smart strategy would be for the practitioner to use their practice’s cash flow to tackle this debt more efficiently. By carefully managing the practice’s finances, it’s possible to pay off that expensive non-deductible debt faster and save thousand of dollars.

While the idea of obtaining a tax deduction is appealing it cannot be the main reason you are doing it. There must be a commercial purpose behind the strategy, namely asset protection. This means increasing the debt against the practice so that if the practitioner is sued, the equity available to a potential litigant is minimised.

Case Example

Recently, I had a dentist (let’s call him Bill) come in to see me with his wife. They had a well-established practice, lived in a beautiful

big house held in the wife’s name for asset protection reasons. The problem however is that they had a one-million-dollar (non-deductible)

mortgage that was eating up all their cash- flow!

By way of background, Bill is a sole trader dentist, with a Service Trust to which he pays a 60% of his professional fees based on his professional billings.

I see a lot of professionals in this situation, where they spend their lives paying back a loan to the bank, only to see their money going down the drain, in interest repayments.

Bill and his wife looked at me with despair, in the hope that I would come up with a practical solution to their problem.

So, I asked them this question. If I could show you how to arrange your practice banking so that we can achieve asset protection by building up the debt against your practice and at the same time paying off your home loan and recycling it into tax deductible debt, would you be interested? The answer was a resounding yes! So I went on to explain how this could work.

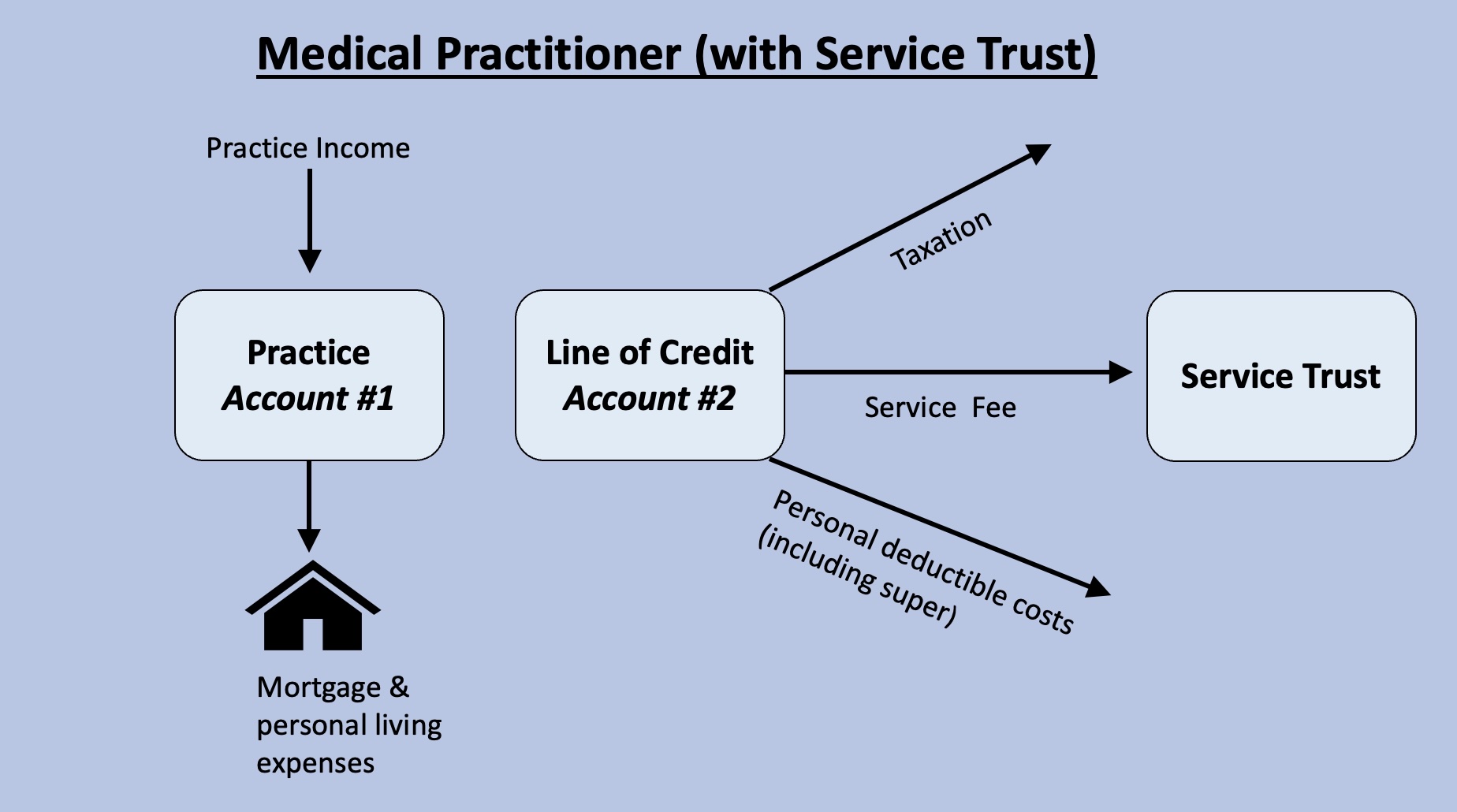

The 2 Account System

As way of background, Bill is a sole trader dentist, with a Service Trust to which he pays 60% of his professional fees in service fees plus lab fees.

Step 1: Bill will bank all of his practice income into his existing sole trader bank account. We will call this bank account #1

Step 2: Bill will set up a line of credit in his name as a sole trader. This will be used to pay all his business expenses. e.g. service fees, and all other business expenses including tax and super that he currently pays from his sole trader account. We will call this bank account #2. This loan should be entirely separate from all other loans, although it can be secured against residential property if there is sufficient equity in a property to allow this.

Step 3: At the end of each month the funds in bank account #1 (less any personal living expenses) will be transferred directly into the housing loan, until the home mortgage is paid off!

Step 4: Meanwhile

bank account #2 (the line of credit), will be used for all the business expenses. e.g.Tax

payments, Service Fess and Superannuation.

Step 5: At the end of every financial year

June 30th, Bill

will calculate the interest that has accrued on the line of credit and transfer this amount from account #1 to account #2. This is

important because the interest cannot be allowed to capitalise.

Step 6: Once the home mortgage has been paid in full, Bill will go to the bank and ask them to refinance the line of credit, with a principal and interest loan in his sole trader account.

Step 7: Now that Bill has recycled all debt on the home loan, to a business loan, he will go back to using bank account #1 for all business income and expenses.

Here's what it looks like:

How Much Tax Could You Save?

If you have a tax deductible loan for $1,000,000 and pay interest of 6% p.a. which is $60,000 p.a. If your tax rate is 47% you would save tax of $28,200 p.a. each and EVERY year. And claiming the interest on your mortgage will not trigger capital gains tax when you sell your home. This is because the interest you are claiming is on the business overdraft and not on your home!

As always, don't hesitate to contact us for help so we can help you understand how this applies to your situation..

Chris Tolevsky has over 30 years experience in the medical

and allied health fields. He provides expert guidance on tax strategies, building and protecting wealth . If you’re interested in

discussing how we can help you please book a complimentary consultation. .

Disclaimer: This article contains general information only . It is not designed to be a substitute for professional advice and does not take into account your individual circumstances, so please check with us before implementing this strategy to make sure it is suitable