Doctors Guide to Buying Rooms Through Super

Buying your rooms through super has become a very popular strategy for Doctors. Under the right circumstances it can be an excellent wealth

creation strategy. However, it is not necessarily right for every Doctor.

Buying your rooms through super has become a very popular strategy for Doctors. Under the right circumstances it can be an excellent wealth

creation strategy. However, it is not necessarily right for every Doctor.

What is a Self Managed Super Fund (SMSF)?

Before we look at buying property and borrowing in super, it is important to understand what a (SMSF) is, how it works. You can choose to contribute your superannuation contributions to either an independently managed superannuation fund such as a life office or industry superannuation fund. Alternatively, you can contribute into your own Self Managed Super Fund (SMSF). The difference is that the members of the SMSF are also the trustees – they control the investment of their contributions and the payment of their benefits.

Here are the basic rules:

- A SMSF must have a trust deed.

- It must have 6 or less members.

- It must have a Trustee.

- If the trustee is a company all members must be directors.

- A member of the fund cannot be an employee of another member unless they are related.

- The trustee cannot receive any remuneration for their services as trustee.

- The trustees must make investments in accordance with the investment rules outlined by the Australian Taxation Office (ATO) and the funds investment strategy.

A self managed super fund looks like this:

Trustees: Make investing decisions on behalf of members.

Superannuation Fund: Invests the money for members.

Members: Get the money on retirement.

A SMSF can invest in:

- Term deposits or bonds.

- Industrial or commercial real estate

- Shares and Cryptocurrency

- Managed funds

- Options Trading

- Covered calls

- Residential real estate

- Offshore investments

- Property Trusts

- Antiques and Art.

- Rare collections (like coins and stamps, motor vehicles etc)

- Loans (providing they are not made to members or their associates)

A SMSF cannot:

- Run a business within the fund.

- Provide financial assistance to friends or family.

- Buy art as a fund investment then hang it on your wall.

- Buy wine as an investment and then drink it.

- Buy jewelry as a fund investment and then wear it.

- Use any of the assets of the fund for your own personal use or allow members (or associated persons) to use those assets.

- Invest in futures.

- Buy personal assets (such as residential real estate) from you, your family or, “associates”

- Lend money to you, your family or ‘associates.’

- Buy a residence for you to live in.

- Pay you, or your family any type of fee.

- Invest more than 5% of its funds in what’s known as “In-house assets” (a loan to or an investment in or a lease with a related party.

What Are Your Responsibilities as Trustee?

- You must have an investment strategy

- You must keep proper records for 10 years,

- You must keep your superannuation assets separate from personal names.

- You must not lend superannuation money to members or relatives

- You must buy and sell assets at true market value

- You must make sure contributions are allowable

- You must be aware of the rules when buying assets from a related party

i.e. Trustees are prohibited from acquiring assets for their self managed super fund from a related party of the fund. There are a number of reasons for this rule. It is to ensure that trustees are not making contributions to the fund that they are not entitled to make. It also discourages trustees from contributing personal assets to the fund as it is likely that they would use those assets themselves.

If trustees acquire assets from a related party of the fund, they may pay too much for the asset (rather than pay market value), therefore allowing money to be withdrawn from the fund earlier than allowed. Limited exceptions to this rule are shares, units or bonds listed on an approved stock exchange acquired or business real property and acquired at market value.

You must not allow in-house assets to exceed 5% of total assets. An in-house asset is any of the following:

- A loan to a related party. e.g. relative

- An investment in a related party e.g. Investing on someones business.

- A lease of a fund asset to a related party.e.g. car, holiday home.

Exceptions are, business real property, such as commercial premises. These can be subject to a lease between a self managed super fund and a related party of the fund.

How to Set up Your SMSF

- Make sure that you have at least $250,000. If you are not sure how much you have all you need to do is call your current superannuation provider and request a member’s statement

- Check with your current superannuation fund provider that you are able to rollover the money into your own SMSF. You should also check to see if there are any early withdrawal fees.

- Set up a SMSF trust deed, it’s own Tax File Number, Australian Business Number and notice of approval from the Taxation Office. You will also need a Trustee Company. This is a special purpose company and does not need a TFN.

- When issued with your SMSF Tax File Number (TFN), Australian Business Number (ABN) and letter of approval from the Tax Office go to your bank and open up an account with them in the name of your SMSF.

- Notify your current superannuation provider that you wish to rollover your entitlements into your own SMSF.

- Notify your current employer that you wish to have all future superannuation benefits paid into your own SMSF.

- Before you start making investments, you must prepare an investment strategy in writing, which documents how you plan to achieve the fund’s investment objectives.

How To Purchase Your Practice Premises in your SMSF

The investment rules for SMSF state that you can now borrow to buy an investment property in your SMSF. which can include your practice premises. This opens up opportunities for super funds with smaller fund balances that want to buy real estate but do not have all the funds available.

For example:

Let’s say you want to purchase an investment property for $400,000 (including costs) but only have

$100,000 in your SMSF.

The fund trustee puts up the deposit for the property of $250,000. The trustee goes to the bank and organises a loan for the balance of $750,000 in the name of the trustee (on behalf of the super fund).

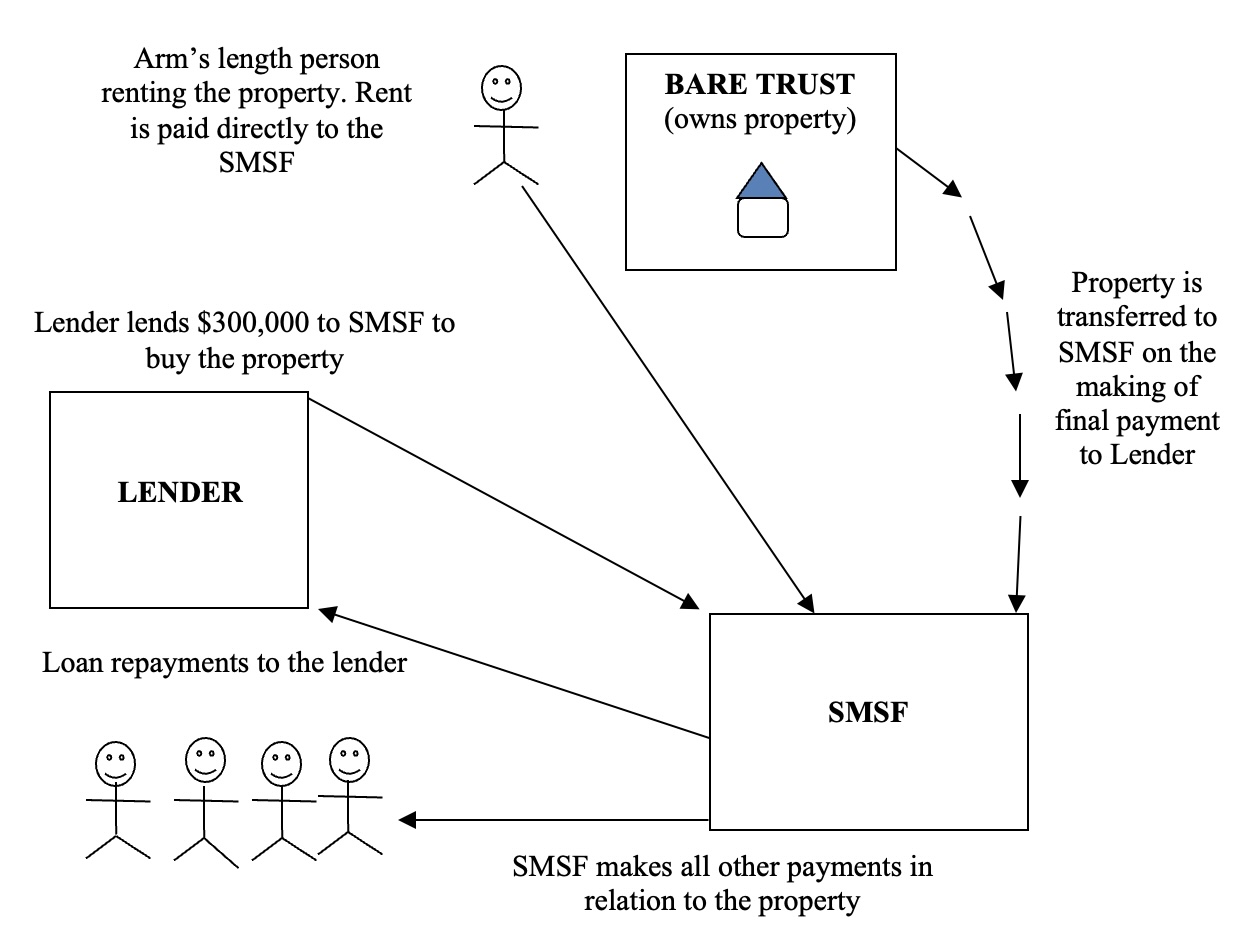

The bank takes a first mortgage over the property. The property must be held in a separate “Bare Trust”, with a separate company as trustee. This trust holds the property until the loan has been paid out and at which time it gets transferred into the super fund clear of stamp duty and CGT.

The superfund now rents out the property, collects rent and pays all expenses including outgoings and loan repayments.

The superfund has the option to either repay the loan and in the end take legal title to the property. Alternatively, before the end of the loan term the superfund can sell the property and pay back the outstanding loan to the bank.

If the fund trustee defaults on the loan at any stage, the bank can sell the property to recoup the amount outstanding on the loan. The lenders recourse is limited to the property being financed .

Here's what it looks like:

If you own your own business you can purchase industrial or commercial premises in your SMSF and rent them back to your practice – and the rent is tax deductible. If you already own practice premises you are also allowed to sell your business premises to your SMSF, providing you do so at “market value”.

This strategy effectively allows you to be your own tennant and when you retire, you can sell the business as usual and the purchaser can

rent the premises from your SMSF.

Consider this example…

The Doctor pays rent to his superfund of $100,000 from his practice which he claims as a tax deduction at is marginal tax rate .e.g. 47%. The SMSF pays tax on the rent received as income at 15%. This means the Doctor has a tax advantage of 32% or $32,000 p.a.

Over ten years, the Doctor is better off by $320,000, not to mention the compounding effect of having this money invested.And here’s the great part. If your SMSF pays the Doctor a pension, i.e. he is aged 65 and does not need to be retired) the rental received will be tax-free in the SMSF! The Doctors advantage is now $47,000 p.a. or $470,000 over ten years!

At some stage, a Doctor will retire, so he may choose to sell the premises. Provided he is paying himself a pension at the time of the sale, any capital gain made on the sale of the premises will be capital gains TAX-FREE!

Alternatively, If the SMSF decides to rent the business premises to the new business owner , the rent received by the superfund will be

TAX-FREE, providing the Doctor is paying himself a pension from his SMSF. This strategy should be considered by every doctor , not only for

the tax savings, but for the capital growth over time, that will help you build your wealth faster and retire sooner!

Chris Tolevsky has over 30 years experience in the medical and allied health fields. He provides expert guidance on tax

strategies, building and protecting wealth . If you’re interested in discussing how we can help you please book a complimentary

consultation.

Disclaimer: This article contains general information only . It is not designed to be a substitute for professional advice and does not

take into account your individual circumstances, so please check with us before implementing this strategy to make sure it is suitable