How To Save Tax Using a Company

Here’s the thing: your business isn’t just a way to make money—it can also help you save tax and protect your assets. With the right setup, you can keep more of your cash and shield your wealth from risks. Whether you’re just starting out or running a bigger operation, smart strategies can make a huge difference. Let’s take a look at how your company can work harder for you

When most people think of a company, they think of a company listed on the Stock Exchange, like BHP or NAB. But the vast majority of companies in Australia are owned by people with small businesses. Most of the large companies are publicly traded, with their stock listed on one of the stock exchanges, but privately held companies, also known as Proprietary Limited Companies ("PTY LTD"), are not listed.

For legal purposes, a company is a separate legal entity that has its own legal existence, as well as its own common and tax laws. The

people who own the company are the shareholders, and the people running the company are the directors.

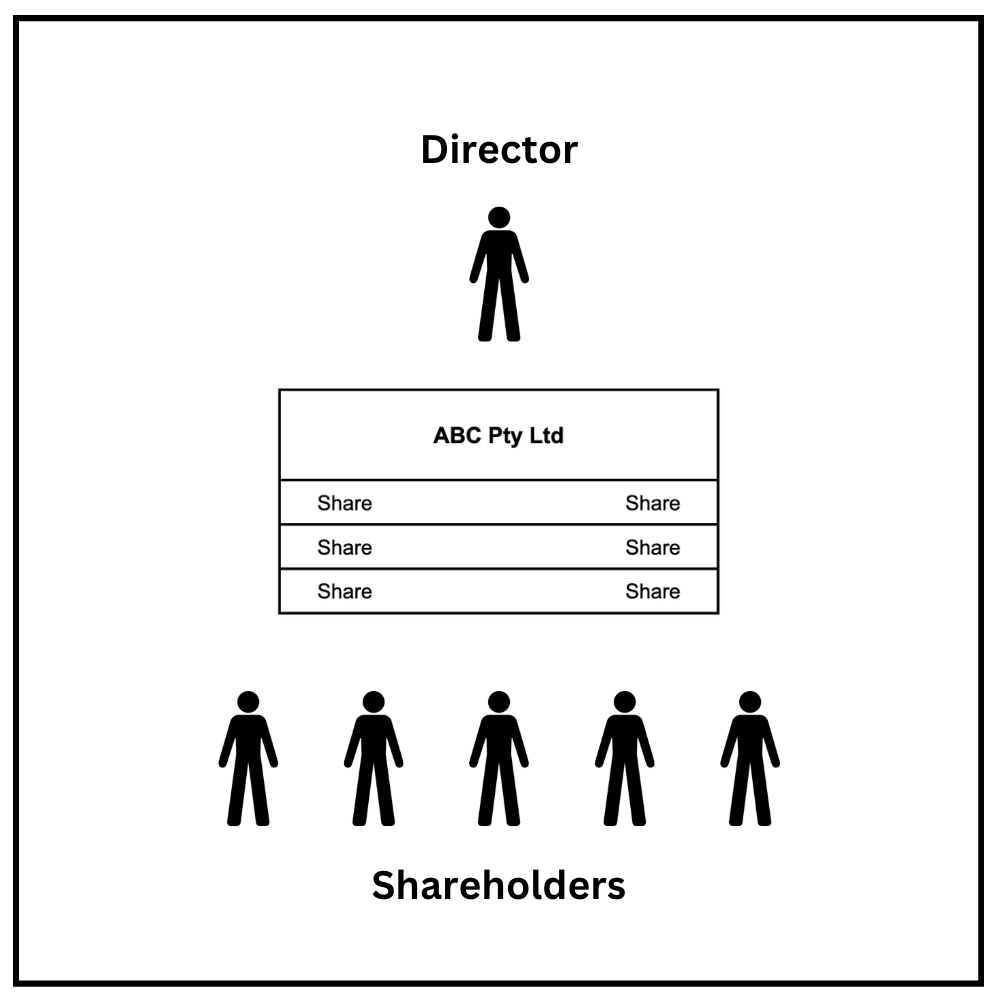

A Company Looks Like This:

Directors: control & are responsible for the company. NOT necessarily the owners.

Company: is a legal entity 1.e. it exists independently of directors and owners.

Shares: the company is divided into portions. Each portion is called a share. Shares are ownership rights i.e. if you own shares you own a part of the company.

Shareholders: Own the shares. i.e own the company.

This company structure could be used for one family or several unrelated parties who go into business together each with their own

percentage of shareholdings. It is simple to set up and requires the lodgement of a tax return each financial year and an annual return

with the Australian Securities Commission (ASIC) which lists the directors and shareholders for public record.

What Registrations Does a Company Need?

The company must apply for an ABN and if it has has turnover of > $75,000 it must register for GST. If it has employees it must also register for Pay as You Go Withholding Tax and pay Superannuation Guarantee Levy on wages to employees. The complete set -up of the company and all registrations are handled by Tolevsky Partners. All you need to do is register for work cover.

We also highly recommend that you set up a bookkeeping system like Xero to make lodging tax returns and Business Activity Statements (BAS) a breeze. We can train you how to use Xero (DIY) or we can do it all for you as part of our "done for you service".

If you are a newly established business we recommend you download our "New Business Starter Kit" which can be downloaded FREE on the right side of this page. It will give you everything you need to know about starting a business.

Can Directors and Shareholders be Sued?

With a company structure, the assets the company owns can potentially be “attacked” by litigants. This is why you should never buy real estate, shares, or any other assets in a company that is trading. The directors can hide behind the "corporate veil," which basically means that the directors are protected by the company structure and cannot be sued. If this is the case, only the assets of the company can be seized. However, special powers are given to some authorities to go behind the company and sue the directors. For example, the Australian Taxation Office (ATO) has the power, where it is owed money by a company, to sue the directors personally for amounts owed by the company. Also, if the actions of the directors are criminal, then the directors can be sued. The good news is that the owners of the company, i.e., the shareholders, cannot be sued.

What Happens if the Company Makes a Profit?

The directors and others can be employed by the company and receive a salary. If the company makes a profit, it pays a flat tax rate of 25%. The profits can then be either retained in the company or paid out as a dividend to the shareholders. In this case, the shareholders will declare the dividend on their personal tax return. They will pay tax at their marginal tax rate and receive a tax credit on the amount of tax paid by the company. For example: Let's say the shareholder received a dividend of $1,000 and their tax rate was 47%. The taxpayer would need to pay $470 in tax, less the $250 tax paid by the company, i.e., $220 in top-up tax.

Note: If you are running your medical or dental practice via a Company structure earning Personal Services Income you cannot retain profits in the Company. All profits must be distributed to the practitioner by way of salary and directors fees.

Who Should Hold the Shares in the Company?

For asset protection reasons, it is always best to hold the shares of the company in the name of the person who is considered 'low risk.' For example, in a mum-and-dad business, you might have the dad as the director who is the "risk taker" and have the wife as the shareholder, the "risk averter."

Sometimes for asset protection reasons, we may choose to hold the shares in a Discretionary Trust. This also gives the additional benefit of greater flexibility with distributions, which can reduce the overall tax paid. Rather than just paying a dividend to an individual shareholder, we can pay the dividend to a Discretionary Trust, which can then distribute to multiple beneficiaries at lower tax rates.

Your choice of business structure is a very important decision and its not one size fits all. That is why you should always discuss your personal situation with us to make sure the structure you decide on is the right one for your business.

As always, don't hesitate to contact us for help so we can help you understand how this applies to your situation..

Chris Tolevsky has over 30 years experience in the medical and allied health fields. He provides expert guidance on tax

strategies, building and protecting wealth . If you’re interested in discussing how we can help you please book a complimentary

consultation.

Disclaimer: This article contains general information only . It is not designed to be a substitute for professional advice and does

not take into account your individual circumstances, so please check with us before implementing this strategy to make sure it is suitable.