How To Improve Your Cashflow #3

Available cash tends to get tied up in what is known as the working capital cycle (WCC). Every business, regardless of what they do, has a working capital cycle.

To start any business, cash is required. This cash is then used to purchase stock in order to generate a sale. When the stock is sold it is

either by way of a cash sale or is charged to an account, creating a debtor. When the debt is collected the WCC continues. In a service

industry the stock is work in progress.

To start any business, cash is required. This cash is then used to purchase stock in order to generate a sale. When the stock is sold it is

either by way of a cash sale or is charged to an account, creating a debtor. When the debt is collected the WCC continues. In a service

industry the stock is work in progress.

Imagine that the stock a business buys sits on the shelf, on average, for fifty five days before it is sold and that it takes an average of forty five days to collect the debtors. Each dollar tied up in the WCC takes one hundred days before it returns to the cash position where it can be used again to purchase more stock (refer diagram).

While waiting for that dollar to return, more stock has to be purchased to keep the business operating and to do so, many businesses use their overdraft facility which is costing them money.

If there is no overdraft, they are using their credit funds that could be better used elsewhere. The faster you can turn the WCC, the faster the dollar returns and the less overdraft or surplus funds you have to use. This is where efficiency in debt collection and improving your stock turnover is the key.

Keeping your records

It

is critical that you keep good financial records in business. It doesn’t matter if they are paper based or on a computer software

program but they need to be simple to understand, reliable and accurate. They need to be in a consistent format and designed to provide

information on a timely basis.

It

is critical that you keep good financial records in business. It doesn’t matter if they are paper based or on a computer software

program but they need to be simple to understand, reliable and accurate. They need to be in a consistent format and designed to provide

information on a timely basis.

These records will form the basis of your financial statements and tax returns. Your accountant can help you to determine what records you should keep and what information they should contain. In general you need to keep records of all transactions, accounts receivable, accounts payable, payroll, petty cash and inventory.

Don’t get swamped by data. Some people love to produce reports and it is then that it becomes all too much and easy to set aside. Ask your accountant what you need to measure in your type of business. Set yourself some key performance indicators and produce reports that make sense to you. Things that get measured get managed.

If you don’t understand, ask the questions – or you may be missing out on opportunities to improve the performance of your business.

Collecting debtors

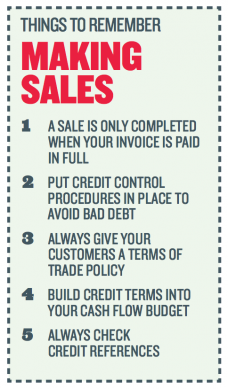

Create a terms of trade policy that can be provided to customers explaining what is expected of them and by you should they not comply by these rules.

Don’t rest on verbal agreements remember this is business and even the best deals can go wrong. Consider how you want to be

paid and how that can impact the cash flow in your business. If you currently trade on cash only basis and are considering offering terms

this should be built into your cash flow budget to determine the impact on your month end cash position. Consider the additional risk to

your business, uncollectible accounts, systems and processes. On the other hand if you get it right it may bring you more business

opportunities and more customers.

If you have exposure to only a couple of major customers this can pose a risk to your business if they get into financial difficulties. Make

sure that you check credit references, that you know who is going to sign the cheques and address the bill to them. Once the bill is

issued you then have to wait for it to be paid.

Want to learn more?

Please click on the links below to view our 4 part series on "How To Improve Your Cashflow"

How To Improve Your Cashflow #1

How To Improve Your Cashflow #2

How To Improve Your Cashflow #3

How To Improve Your Cashflow #4